My Blog

My Newest Articles

How You Can Benefit from 996 vs. Work Life Balance Debate between China and America?

How You Can Benefit from 996 vs. Work Life Balance Debate between China and America?

How You Can Benefit from 996 vs. Work Life Balance Debate between China and America?

“I personally think that 996 is a huge blessing…How do you achieve the success you want without putting in extra effort and time?” This recent post by Jack Ma, Alibaba's founder, caused an intense global debate on work life balance.

Forget about 996, I worked 007 for most of my career (work till midnight, seven days a week)! With experiences working at intense places like Goldman Sachs and Alibaba, I share in this article how the debate helped me, which I hope can help you think through your own work life preference.

Chinese Hustle and The Grapes of Wrath

How You Can Benefit from 996 vs. Work Life Balance Debate between China and America?

How You Can Benefit from 996 vs. Work Life Balance Debate between China and America?

When I arrived China in the summer of 2019, I woke up early and visited a farmers' market at 6:30am. Much to my surprise, it was full of vendors and customers already. This piece is about Chinese farmers' determination to push through the hardships caused by the trade war.

How Can You Win During the Trade War?

How You Can Benefit from 996 vs. Work Life Balance Debate between China and America?

How Can You Win During the Trade War?

In August of 2019 I visited Southeast Asia for the first time. The optimism and entrepreneurial spirit energized me. Little did I know that Southeast Asia has been benefiting from the global geopolitical competition among the greater powers like U.S. and China. Whoever adds value in Southeast Asia will win the trust of the locals.

Additional Published Articles

Free to Create: China’s Quest for an Innovative Economy

Common Fortunes: A closer Engagement with China would benefit the United States

Common Fortunes: A closer Engagement with China would benefit the United States

Gradually recognizing that the growth model for China needs to be more sustainable, Chinese leaders have emphasized innovation as an engine to stimulate growth. This essay analyzes existing best practices for advancing China’s innovation economy. I highlight Silicon Valley as an innovation zone and examine its application in the Chinese political context. This essay stems from my study advised by Stanford’s Professor Myron Scholes, Nobel laureate in Economics.

Common Fortunes: A closer Engagement with China would benefit the United States

Common Fortunes: A closer Engagement with China would benefit the United States

Common Fortunes: A closer Engagement with China would benefit the United States

Back in 2010 when I was still in college, I didn't know that the relationship between China and America would become the world's most important bilateral relationship. But following my natural interest in these two countries as an immigrant, I published a piece highlighting the mutual benefits for both American and China if these two countries could engage with other other more closely.

Few years later, I find that the U.S.-China relationship has become evermore important and complex. So I want to share this piece now, which still represents my views today, with others who are also interested in helping build a constructive relationship between these two countries.

Is Entrepreneurship Replacing English as the World Language?

Common Fortunes: A closer Engagement with China would benefit the United States

We Need a Thriving American Democracy - my conversation with former Secretary of State

I experienced many cognitive dissonance traveling between Silicon Valley and China. These two places are more similar than the popular media shows. Check out this article on why I argue entrepreneurship is the new world language.

We Need a Thriving American Democracy - my conversation with former Secretary of State

We Need a Thriving American Democracy - my conversation with former Secretary of State

We Need a Thriving American Democracy - my conversation with former Secretary of State

I was a student of the 66th US Secretary of State Dr. Condi Rice at Stanford. I took the small weekly seminar "Challenges and Dilemmas in American Foreign Policy" with Dr. Rice where students engaged in lively debates with the former top American diplomat. Every week, I would read 500-700 pages and write a 5 page concise reflection, which Dr. Rice herself evaluated. I can't overstate how stressful it was to write policy papers to be graded by the former Secretary of State. The class was a blast! I will annoyingly brag that I received an A:)

Read Like a Nobel Prize Winner

We Need a Thriving American Democracy - my conversation with former Secretary of State

Be Weird! A Winning Strategy in Investing and Life

Two years ago, I wrote on how to learn like Professor Myron Scholes, Nobel Prize Winning economist and co-inventor of Black Scholes model. Professor Scholes and I have developed a working relationship since my time at Stanford. Here is the summary of Professor Scholes' principles of learning:

Be Weird! A Winning Strategy in Investing and Life

We Need a Thriving American Democracy - my conversation with former Secretary of State

Be Weird! A Winning Strategy in Investing and Life

The following personal investing principles are based on my experience in stock investing, working as a strategic investor and advising startups. Many of my millennial friends including myself currently feel anxious about the market after the recent crash. Through my education and work, I have been privileged to have learned from the world's best investors. I hope to share these lessons with other millennials who are building financial security through personal investing. Our learning can be effective only if we support one another through sharing.

Dare to Ask: Top Questions on China for 2019

What This Chinese Born American Learned from His Mistakes About China

What This Chinese Born American Learned from His Mistakes About China

Following up on my published 2018 reflections on China from last week, here are the questions that I am asking myself for 2019 on China. I hope to start a community of open-minded people who see the upside of a constructive US-China relationship. Please share your questions on China in the comment section:)

What This Chinese Born American Learned from His Mistakes About China

What This Chinese Born American Learned from His Mistakes About China

What This Chinese Born American Learned from His Mistakes About China

Every year, I type up my reflections for the year and questions for the next, which I have been circulating privately. This year, to take a bolder step, I am experimenting with "open sourcing" these notes. I welcome the broader internet community to critique my views.

In 2018, I traveled over 100 days across Europe, Asia and North America. My notes are long, so I have broken them into parts. This week's post is on China.

Learn How to Learn from Nobel Prize Winner

What This Chinese Born American Learned from His Mistakes About China

Your next billion dollar idea will be from China

Over a 3 hour dinner, Nobel laureate Professor Myron Scholes generously offered us lifelong wisdom. Particularly, we’d asked Professor Scholes on his learning habits that shaped his mind. We found them invaluable, and would like to share them so more people can benefit from one of the greatest minds of our day.

Your next billion dollar idea will be from China

Full-on Immersion: Total immersion is the best way for foreign students to adapt to new cultures

Your next billion dollar idea will be from China

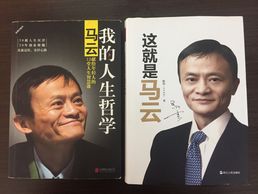

“Mission and values, without these two, everything else is empty.” Jack Ma’s words still sound clear to me after I first heard them in person at Stanford in 2013. It was the best business talk I have heard. Little did I know that four years later, I would leave Goldman Sachs to join Jack’s company. Today, Alibaba is worth ~US$330bn.

In an effort to understand this incredible entrepreneurial journey, I have read two Chinese books about Jack since I joined Alibaba,. Supplemented by my own Alibaba experience, I have learned invaluable lessons on entrepreneurship, business and leadership.

Full-on Immersion: Total immersion is the best way for foreign students to adapt to new cultures

Full-on Immersion: Total immersion is the best way for foreign students to adapt to new cultures

Full-on Immersion: Total immersion is the best way for foreign students to adapt to new cultures

Back in college, I published a two-part series reflecting on the lessons that I learned as a young immigrant to the U.S. I hope to share my lessons with others who are new to America and potentially Americans who just moved to a new country. This is Part II of the series.

Broken Barriers: Learning a new language can teach students valuable lessons

Full-on Immersion: Total immersion is the best way for foreign students to adapt to new cultures

Full-on Immersion: Total immersion is the best way for foreign students to adapt to new cultures

Back in college, I published a two-part series reflecting on the lessons that I learned as a young immigrant to the U.S. I hope to share my lessons with others who are new to America and potentially Americans who just moved to a new country. This is Part I of the series.

US OPPORTUNITIES FOR ASIA-BASED CRYPTO FUNDS

The crackdown on crypto in China is forcing many China-based crypto investors to shift their focus away from China/Asia towards US & Europe. Recently a top Asia-based crypto fund discussed with me about strategies of entering to the US. I put together some thoughts here.

EARLY-STAGE CRYPTO INVESTING

As a refinement to my deck on tech investing, I created this deck to focus on early-stage crypto investing. You will find my new "80 / 20 rule" for how to invest in crypto early.

AN EXCITING TIME TO INVEST IN ENTERPRISE TECH!

As part of my career exploration, I have been discussing taking a lead role in crypto investing with some of the biggest VC funds. I created a deck that synthesizes my highest conviction in tech investing. Below is the executive summary. You can find the full deck here.

Copyright © 2019 Paul Chen's World - All Rights Reserved.

Powered by GoDaddy